Distributing TIA Funds Outlining a TIA Spending Plan

Strong local designation systems have goal-oriented spending plans based on engagement with district and campus-level stakeholders. There are a variety of options for using TIA funds to support district goals for teacher retention, teacher recruitment, and prioritization of high-needs campuses.

The System Application requires the district to outline how and when they spend the allotment, plan for contingencies when designated teachers move, and set a timeline for school board approval.

Guide to TIA Funding Strategies

TIA Spending Plan Guidance for District Receiving Funding for the First Time (PPT)

TIA Spending Guidance for District Business Offices

TIA Payout Calculator

Spending Plan TIA Statutory Spending Requirements

Districts must spend 90% or more of the allotment on teacher compensation on the campus where the designated teacher works. Up to 10% of the allotment may be used by the district to support the local designation system or to support teachers in earning designations.

For the purpose of compensation, a teacher is defined as student-facing instructional staff. This may include instructional aides and paraprofessionals, classroom inclusion support teachers, and other staff members who primarily work directly with students in an instructional setting

Districts are notified of their annual allotment in late April and must spend all funds by August 31 of the same calendar year. Spending requirements and timelines do not apply to fees reimbursed through TIA.

Allowable Spending vs. Prohibited Spending Based on Statute

Allowable Spending for at Least 90% of the Allotment

- Stipends or salary increases for designated teachers

- Stipends or salary increases for other teachers at the campus of the designated teacher(s)

- Compensation for other staff at the campus of the designated teacher(s) whose primary responsibility is instructing students

- Benefits and retirement contributions for teachers at the campus of the designated teacher(s)

Prohibited Spending for at Least 90% of the Allotment

- Compensation for school leaders

- Compensation for non-instructional staff (including instructional coaches that do not teach)

- Compensation for central staff or staff at a different campus from the designated teacher(s)

Allowable Spending for Up to 10% of the Allotment

- Professional development for teachers

- TIA assessment costs

- Rubric costs, appraiser rater training, or certification

- Other student growth costs

- Central supports, such as funding for TIA coordinator or HR needs

- Compensation for staff associated with TIA needs or with professional development, such as school leaders or instructional coaches

- Recruitment, such as job fairs

- Benefits and retirement contributions for teachers

Prohibited Spending for Up to 10% of the Allotment

- General administrative expenses

- Compensation for staff not associated with TIA needs nor with professional development

Spending Plan How to Distribute the Allotment

Within the parameters of the spending requirements, districts may choose to split the allotment funding in several ways. Some districts choose to give the full 100% of funding to the designated teachers. Other districts choose to split the funding to reward other eligible educators who contribute to student success, such as interventionists and instructional paraprofessionals. Districts may use funds from the 10% to provide additional professional development opportunities to designated teachers and teachers who may be eligible for designation in the future.

Often, districts base the funding distribution on overall goals like recruiting more teachers, supporting professional development, or improving teacher retention.

| District Goal | TIA Funding Possibilities |

|---|---|

| Recruit Effective Teachers | Signing Bonuses Higher Starting Salaries Opportunities for Pay Increases in the First Few Years |

| Support Educator Development | Stipends to Acquire Specific Knowledge and Pedagogical Skills Increased Compensation for Serving in Leadership Roles or Mentoring New Teachers |

| Improve Retention | Annual Retention Bonuses Career Pathways that Increase Compensation and Provide Growth Opportunities Within the Classroom |

Example Funding Distribution

| 60% Designated Teacher | 30% Support Teachers | 10% District Use |

Spending Plan Methods of Compensation

Spending plans can take many forms. The two main types of plans are those based on stipends or raises to base salaries.

Stipends are a simple method for targeting additional pay aligned with district priorities such as recruitment and retention of high-quality teachers or providing incentives for teaching in high-need schools. Since stipends are extra payments outside of a teacher’s base salary, the stipend payment is lost if a teacher is no longer eligible.

Stipend Funding Example

| Payment Schedule | Recognized | Exemplary | Master |

|---|---|---|---|

| Payment 1; Paid in May | $1,500 | $6,000 | $12,000 |

| Payment 2; Paid in August | $3,000 | $9,000 | $18,000 |

In this example, the stipends are paid out in two payments, with a larger final stipend paid in August as a retention bonus for those educators returning to the school.

Salary-based plans provide a raise to a teacher’s base salary. Districts adopting a base salary raise plan need to decide if it involves:

- Adding performance-based lanes to the existing salary schedule

- Creating a new salary schedule based on performance

- Providing performance-based raises – either fixed amounts or percentages – for designated teachers or other eligible educators

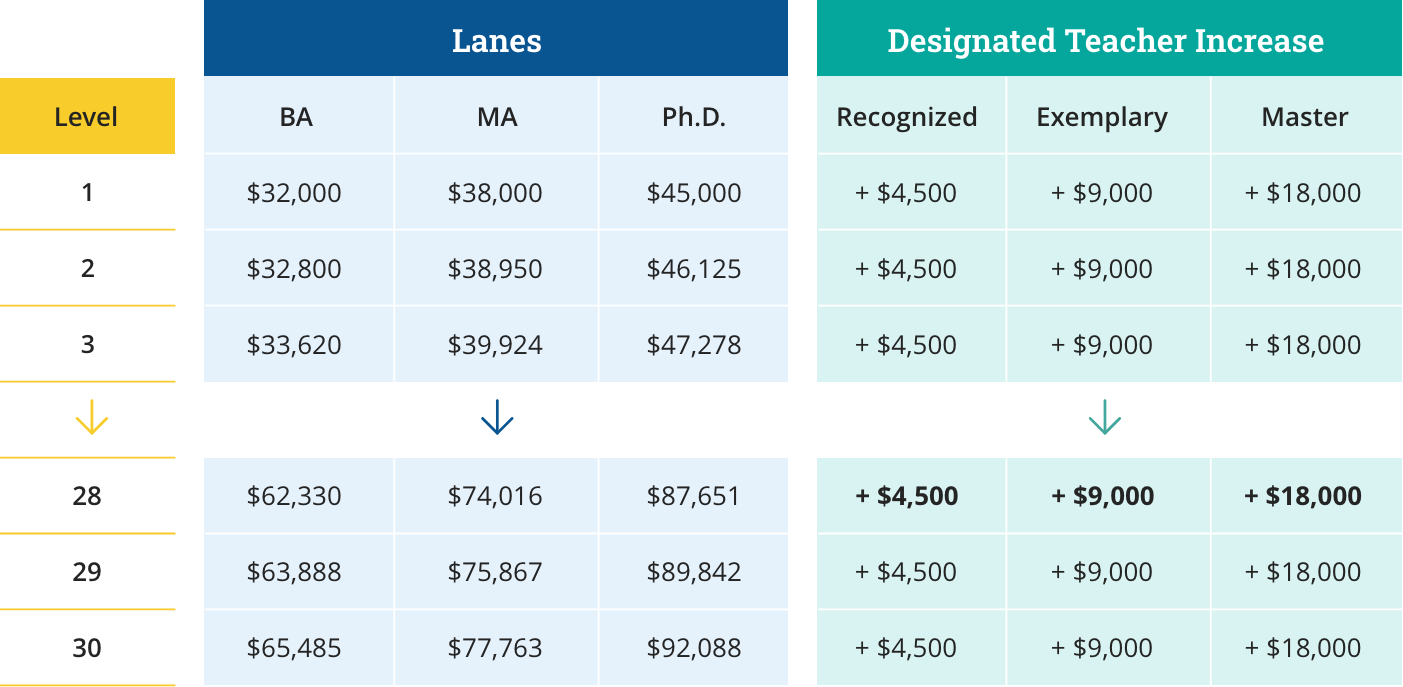

Salary Raise Funding Example

| Steps | BA | MA | PH.D | Recognized | Exemplary | Master |

|---|---|---|---|---|---|---|

| 1 | $32,000 | $38,000 | $45,000 | $4,500 | $9,000 | $18,000 |

| 2 | $32,800 | $38,950 | $46,125 | $4,500 | $9,000 | $18,000 |

| 3 | $33,620 | $39,924 | $47,278 | $4,500 | $9,000 | $18,000 |

| 30 | $65,485 | $77,763 | $92,088 | $4,500 | $9,000 | $18,000 |

In this example the TIA performance raise for designated teachers is created by adding lanes to the district’s standard teacher salary schedule. The amounts in the Recognized, Exemplary, and Master lanes are added to the designated teacher’s salary based on where they fall within the standard steps and lanes.

The district can combine salary raises with stipends to align compensation with additional district goals. For example, the district could develop a salary schedule and offer stipends for signing bonuses or retention bonuses.

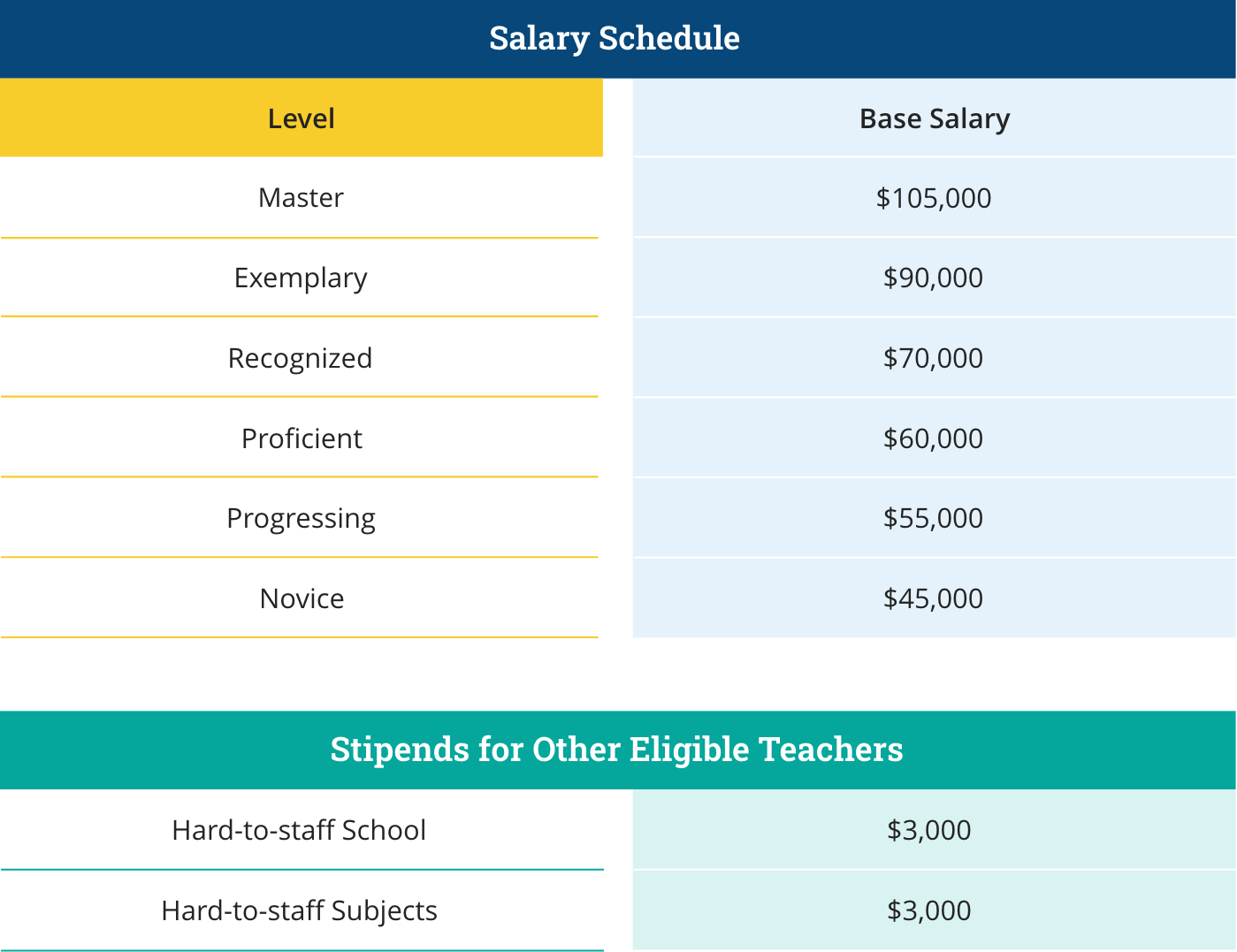

Combined Stipend and Salary Raise Funding Example

| Salary Step | Base Salary | Stipend | Amount | |

|---|---|---|---|---|

| Master | $105,000 | Hard-to-Staff School | $3,000 | |

| Exemplary | $90,000 | Hard-to-Staff Subject | $3,000 | |

| Recognized | $70,000 | |||

| Proficient | $60,000 | |||

| Progressing | $55,000 | |||

| Novice | $45,000 |

This example uses a salary schedule ranging from Novice for new teachers to Master for the highest performing teachers. It includes stipends of $3,000 as an incentive for teachers to work in hard-to-staff schools and hard-to-staff subject areas.

Timing may direct the choices a district makes. Some districts pay out stipends in the first year and then change to salary schedules in subsequent years.

If a district chooses to adopt a stipend plan, they must decide if the stipend will be paid in a single lump sum payment or in multiple payments over several weeks or months. Districts adopting a base salary raise plan need to decide how the raise is added.

Planning for Teacher MovementSpending Plan Planning for Teacher Movement

TIA allotments are based on the campus of a designated teacher. As part of their System Application, districts should develop a plan for allocating funds when a designated teacher moves to another district.

Allotment values are determined by each designated teacher’s campus as of the last Friday in February. Funds do not follow designated teachers in real time, and allotments are not prorated between campuses or school districts. If a designated teacher moves districts mid-year, the timing is paramount to determining which district, if any, receives the funds. Districts must outline how the spending plan will adjust when teachers move into or out of the district before and after the February snapshot date. As a best practice, districts should have a plan to adjust or account for actual allotments received, which are finalized in April each year.

Districts need a plan for teachers who resign or retire prior to the scheduled payout date. Some districts may choose to forward the full or remaining payment to the designated teacher who earned the funding in one lump stipend payment. Other districts may choose to compensate supporting teachers who remain on campus to help their retention goals. If the district chooses not to forward allotment funds, the district must still spend at least 90% on teacher compensation on the campus where the designated teacher worked by August 31 of the same calendar year.

Districts spending plans should take into account National Board Certified Teachers (NBCTs) and designated teachers who move into a district. Some districts differentiate spending plans if the designation was earned outside the local designation system. Most districts apply the same spending plan to all designated teachers.

Formalizing Your Compensation PlanSpending Plan Formalizing Your Compensation Plan

Once a district has narrowed down spending plan options, the TIA lead(s) may work with the district business office to examine the feasibility of each option and consult with impacted departments. TIA spending plans often require additional support from the district CFO, payroll department, or human resources. Prior to completing the System Application, the district must finalize decisions on the timing, amount, and mode of compensation, and ensure district departments have the capacity to implement the spending plan. Once the district’s System Application is accepted, the district may amend their spending plan and/or budget through their normal local procedures.

Districts should obtain school board approval of the proposed spending plan. Most districts choose to either do this annually or the summer before they anticipate designating and compensating TIA teachers, which is often the year after the Data Capture Year. Once the district’s System Application is accepted, best practice is to communicate the spending plan to teachers and stakeholders and make it accessible.

TIA Spending Best Practices and Exemplar Plans

Spending Plan FAQs

How can districts use the allotted funds?

Districts must spend at least 90% of the allotment on teacher compensation on the campus of the designated teacher, while up to 10% can be used to support the local designation system.

Within these parameters, districts may choose to split the allotment funding in several ways. Some districts choose to give the full 100% of funding to their designated teachers. Other districts choose to split the funding to reward other eligible educators who contribute to student success, such as instructional paraprofessionals.

Districts may use funds from the 10% to provide additional professional development opportunities to designated teachers and teachers who may be eligible for designation in the future.

Learn more about how districts are allowed to use the allotted funds.

What is an example of a TIA stipend plan?

In this example, the stipends are paid out in two payments, with a larger final stipend paid in August as a retention bonus for those educators returning to the school.

What is an example of a TIA salary raise plan?

In this example the TIA performance raise for designated teachers is created by adding lanes to the district’s standard teacher salary schedule. The amounts in the Recognized, Exemplary, and Master lanes are added to the designated teacher’s salary based on where they fall within the standard steps and lanes.

What is an example of a TIA combination plan?

This example uses a salary schedule ranging from Novice for new teachers to Master for the highest performing teachers. It includes stipends of $3,000 as an incentive for teachers to work in hard-to-staff schools and hard-to-staff subject areas.

How do districts manage allotments if designated teachers leave?

Districts need a plan for teachers who resign prior to the scheduled payout date. Some districts may choose to forward the full or remaining payment to the designated teacher. Other districts may choose to use the funds to compensate teachers who remain on the campus. All funds must be spent by August 31.

Is the allotment for the teacher or the campus?

Funding for teachers designated as Recognized, Exemplary, and Master under TIA are awarded to districts, which in turn must spend at least 90% of the funds on teacher compensation on the campuses where the designated teachers work.

TEC Section 48.112 (i)(1)(A): A district shall annually certify that funds received under this section were used as follows: At least 90% of each allotment received was used for the compensation of teachers employed at the campus at which the teacher for whom the district received the allotment is employed.

Will there be spending codes for TIA funds?

There are no PIC codes for TIA funds. Funding and reimbursement of fees are a separate line item in FSP payments.

If a district does not have a local designation system as part of the Teacher Incentive Allotment, but employs designated teachers, will the district receive allotment funds for those teachers?

Yes. Districts that employ teachers who have earned designations will receive funding for those teachers based on the TIA formula, even if the district does not have an approved designation system in place.

For example, a district that does not have a designation system in place could employ a teacher that earned a designation in another district or a teacher who automatically earned a Recognized designation for having achieved National Board Certification. Districts need to develop a plan for how to spend allotment dollars that they receive, in accordance with the statutory requirements.

If a designated teacher moves campuses from one school year to the next, will the allotment that teacher generates be recalculated? What if a teacher leaves in the middle of the year?

While designations are tied to the teacher and not their employing district or campus, allotment funds are awarded to the district where the teacher was employed as of the last Friday in February. For teachers who meet eligibility criteria, the district employing the teacher as of the last Friday in February will receive funds for that school year and must spend the allotment funds by August 31. The percentage of allotment awarded to the designated teacher varies by district. Districts are not required to forward funds if the teacher resigns or retires before August 31. If a designated teacher moves to a new district or campus between school years, the allotment for the next school year will be recalculated in April based on the new campus’ rural status and level of socioeconomic need.